Why It Matters

A company’s ability to control prices is a crucial indicator of competitive moat and market position, but systematically evaluating pricing power across scattered news coverage, earnings calls, and filings is resource-intensive and inefficient. Investment decisions need systematic analysis of pricing dynamics to identify companies with sustainable competitive advantages.What It Does

Using the functions available in thebigdata-research-tools package, you can create a comprehensive pricing power analysis tool that assesses competitive positioning across company watchlists using unstructured data from news sources. These functions are suitable for analysts, portfolio managers, and investment professionals to create tools that transform scattered pricing signals into quantified competitive intelligence and identify investment opportunities based on sustainable pricing advantages.

How It Works

This workflow combines dual-theme sentiment analysis, temporal tracking, and confidence-based scoring to deliver:- Positive vs. negative pricing power assessment measuring both pricing strength and competitive pressure signals

- Sector-wide comparative analysis revealing industry patterns and competitive positioning dynamics

- Temporal evolution tracking showing how pricing narratives develop and change over time

- Confidence scoring system quantifying the balance between positive and negative pricing power mentions

A Real-World Use Case

This cookbook demonstrates the complete workflow through analyzing pricing power dynamics across a company watchlist using news data, showing how the miner automatically identifies pricing leaders, tracks competitive positioning changes over time, and reveals sector-specific pricing patterns through automated narrative analysis. Ready to get started? Let’s dive in!

Prerequisites

To run the Pricing Power Analysis, you can choose between two options:-

💻 GitHub cookbook

- Use this if you prefer working locally or in a custom environment.

- Follow the setup and execution instructions in the

README.md. - API keys are required:

- Option 1: Follow the key setup process described in the

README.md - Option 2: Refer to this guide: How to initialise environment variables

- ❗ When using this method, you must manually add the OpenAI API key:

- ❗ When using this method, you must manually add the OpenAI API key:

- Option 1: Follow the key setup process described in the

-

🐳 Docker Installation

- Docker installation is available for containerized deployment.

- Provides an alternative setup method with containerized deployment, simplifying the environment configuration for those preferring Docker-based solutions.

Setup and Imports

Below is the Python code required for setting up our environment and importing necessary libraries.Defining your Pricing Power Analysis Parameters

Fixed Parameters

- Pricing Power Theme (

pricing_power_theme): The central concept to explore for positive pricing power - Lack of Pricing Power Theme (

no_pricing_power_theme): The concept to explore for negative pricing power - Pricing Power Sentences (

pricing_power_sentences_list): Sentences used to improve the retrieval regarding the Pricing Power theme - Lacking of Pricing Power Sentences (

no_pricing_power_sentences_list): Sentences used to improve the retrieval regarding the Lack of Pricing Power theme - Pricing Power Labels (

pricing_power_labels_list): Labels used to recognize relevant document chunks for the Pricing Power theme - Lacking of Pricing Power Labels (

no_pricing_power_labels_list): Labels used to recognize relevant document chunks for the Lack of Pricing Power theme - Document Type (

document_type): Specify which documents to search over (transcripts, filings, news)

Customizable Parameters

- Watchlist (

my_watchlist_id): The set of companies to analyze. This is the ID of your watchlist in the watchlist section of the app. - Model Selection (

llm_model): The LLM model used to label search result document chunks and generate summaries - Frequency (

freq): The frequency of the date ranges to search over. Supported values:Y: Yearly intervals.M: Monthly intervals.W: Weekly intervals.D: Daily intervals. Defaults to3M.

- Time Period (

start_dateandend_date): The date range over which to run the analysis - Document Sources (

sources): Specify set of sources within a document type, for example which news outlets (available via Bigdata API) you wish to search over - Rerank Threshold (

rerank_threshold): By setting this value, you’re enabling the cross-encoder which reranks the results and selects those whose relevance is above the percentile you specify (0.7 being the 70th percentile). More information on the re-ranker can be found here. - Document Limit (

document_limit): The maximum number of documents to return per query to Bigdata API - Batch Size (

batch_size): The number of entities to include in a single batched query

Retrieve Content using Bigdata’s Search Capabilities

With the pricing power narratives and analysis parameters, you can leverage the Bigdata API to run a search on company news for both positive and negative pricing power indicators.Label the Results

Use an LLM to analyze each document chunk and determine its relevance to the Pricing Power theme or to the Lack of Pricing Power theme. Any document chunks which aren’t explicitly linked to one of these will be filtered out.Visualizations

Sector-Based Pricing Power Visualization

The following visualizations provide a sector-by-sector breakdown of companies mentioned in pricing power contexts. These charts help identify:- Industry Patterns: Which sectors show more pricing power activity

- Market Leaders: Companies most frequently mentioned in pricing power contexts within each sector

- Story Context: Detailed hover information reveals the specific headlines, motivations, and news excerpts driving each company’s positioning

Companies with Pricing Power

This chart displays companies that have been most frequently mentioned in positive pricing power contexts, organized by sector and ranked by total mention volume. The visualization reveals which companies and industries demonstrate strong ability to control prices, raise prices without losing customers, or maintain premium positioning in their markets.Companies Lacking Pricing Power

This complementary chart shows companies most frequently mentioned in negative pricing power contexts, organized by sector and ranked by total mention volume. It identifies firms struggling with price competition, facing customer resistance to price increases, or operating in commoditized markets where pricing control is limited.Pricing Power Confidence Analysis

This comprehensive assessment combines both positive and negative pricing power signals to create a confidence-based ranking system. The analysis provides:- Total Exposure: Overall volume of pricing power related news coverage for each company

- Confidence Scoring: Relative proportion of positive versus negative pricing power mentions

- Relative Ranking: How the top 30 most-mentioned companies compare against each other in terms of pricing power signals

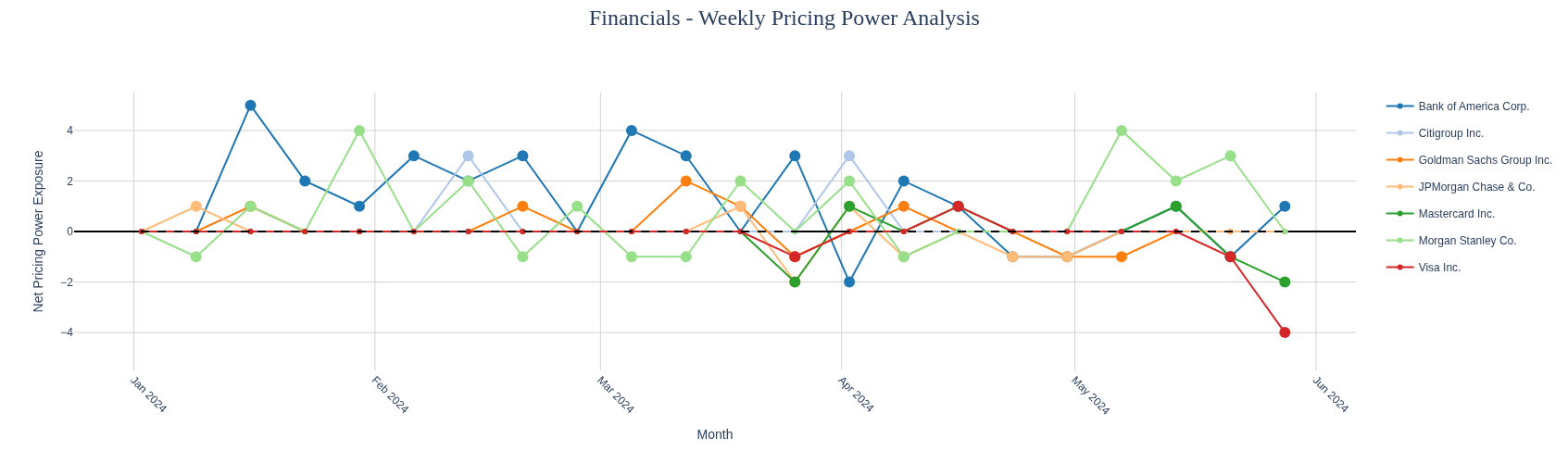

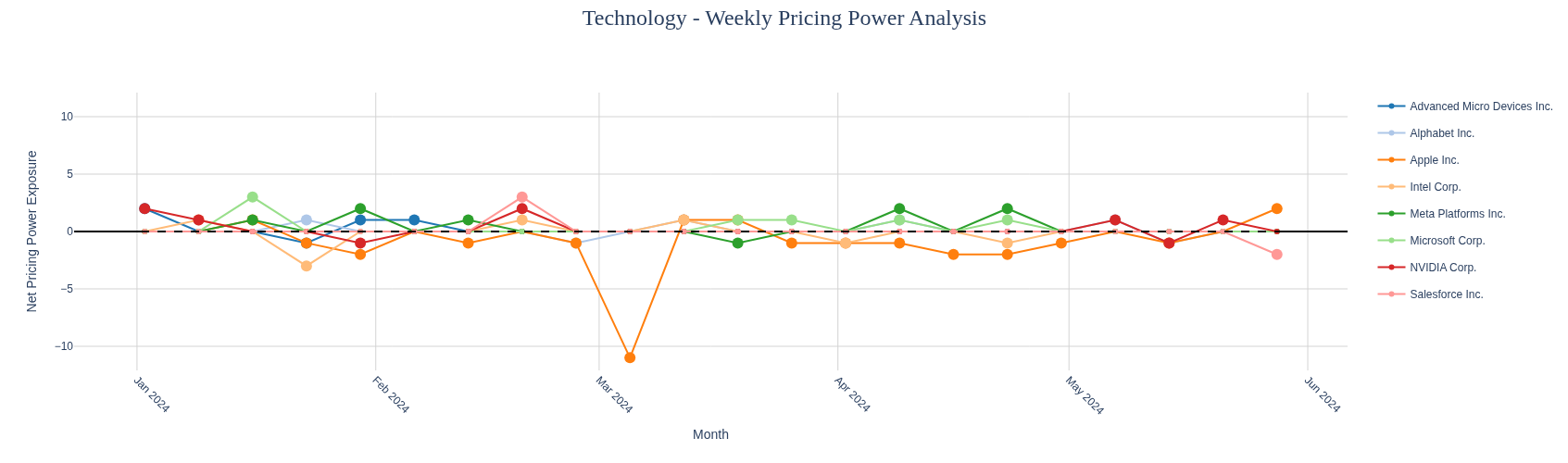

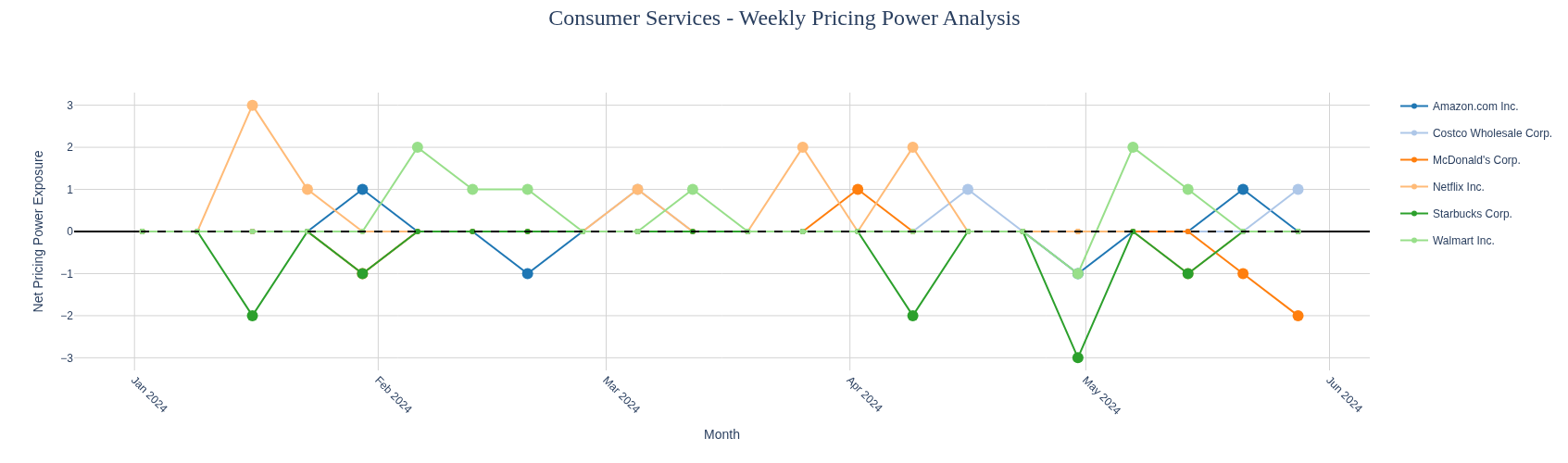

Temporal Pricing Power Analysis

This time-series analysis tracks how pricing power narratives evolve over time for companies in our basket. The weekly analysis reveals:- Narrative Trends: How pricing power stories develop and change over time

- Net Positioning: The balance between positive and negative pricing power mentions over time

Key Insights and Market Stories

The temporal analysis reveals several notable pricing power stories:PepsiCo's Price Resistance

PepsiCo’s price hikes were met with significant resistance from major retailers like Carrefour, which stopped selling PepsiCo products in several European countries. The company experienced declining sales volume in Q1 2024, demonstrating the limits of pricing power when customers have alternatives.

Quick Service Restaurant Challenges

McDonald’s and Starbucks faced customer backlash and reduced customer counts due to their price increases, indicating that even strong brands face constraints when pricing exceeds customer willingness to pay, particularly among price-sensitive consumers.

Successful Pricing Power Examples

Spotify demonstrated strong pricing power within the streaming industry, successfully raising subscription prices while justifying increases through improved product offerings and maintaining customer loyalty.

Export the Results

Export the data as Excel files for further analysis or to share with the team.Conclusion

The Pricing Power Analysis provides a comprehensive automated framework for analyzing pricing dynamics and competitive positioning across your investment universe. By systematically combining advanced information retrieval with LLM-powered sentiment analysis, this workflow transforms unstructured news data into actionable intelligence for strategic decision-making. Through the automated analysis of pricing power narratives, you can:- Identify pricing leaders - Discover companies with sustainable competitive advantages that allow them to control pricing in their markets

- Assess competitive positioning - Compare how companies within sectors respond to pricing pressures and maintain market share when implementing price increases

- Monitor pricing narrative evolution - Track how pricing power stories develop over time, identifying shifts in competitive dynamics and market leadership

- Generate sector intelligence - Create comprehensive reports on pricing dynamics across industries, revealing which sectors face commoditization versus those with differentiation opportunities

- Quantify pricing confidence - The confidence-based scoring system provides clear metrics to identify companies with strong pricing control versus those facing pricing challenges

- Analyze temporal patterns - Weekly tracking reveals how external factors, competitive responses, and market conditions impact pricing power over time